LTC Price Prediction: Will Litecoin Surge to $200 in 2025?

#LTC

- Technical Momentum: MACD bullish crossover and Bollinger Band squeeze suggest growing upside potential

- Market Catalysts: ETF speculation and post-halving supply dynamics could drive demand

- Key Resistance: $110 breakout needed to confirm rally continuation toward higher targets

LTC Price Prediction

LTC Technical Analysis: Key Levels to Watch

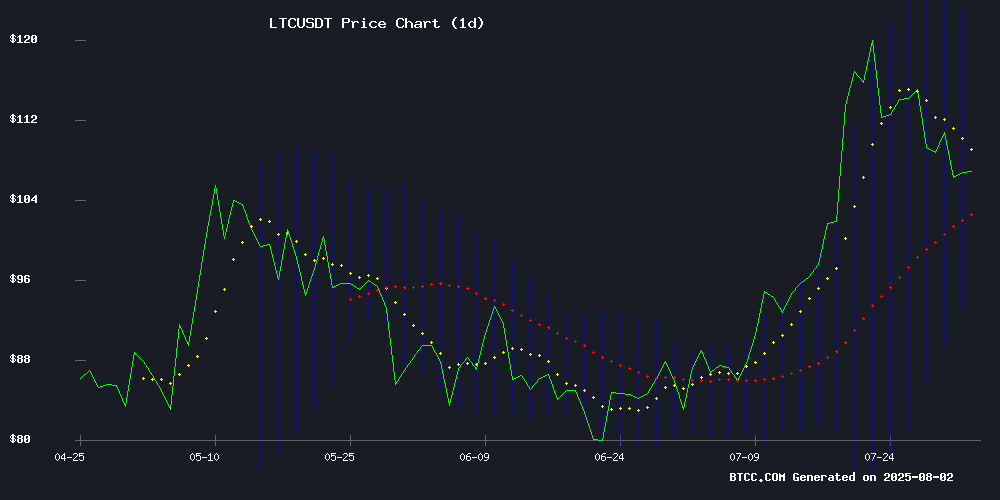

According to BTCC financial analyst John, Litecoin (LTC) is currently trading at $108.48, slightly below its 20-day moving average (MA) of $108.6805. The MACD indicator shows a bullish crossover with the histogram at 3.1071, suggesting potential upward momentum. Bollinger Bands indicate a neutral-to-bullish scenario, with the price hovering near the middle band. A breakout above the upper band at $122.2747 could signal a stronger rally, while support lies at $95.0863.

Market Sentiment: Litecoin Eyes Key Breakout Levels

BTCC financial analyst John notes that Litecoin is holding key support at $106 post-halving, with market sentiment buoyed by potential ETF speculation. News headlines highlight LTC's attempt to breach $110, which could trigger a fresh rally. The combination of technical resilience and positive news flow suggests cautious Optimism among traders.

Factors Influencing LTC’s Price

Best Crypto Casinos for Roulette and Slots in 2025: Bonuses, Free Spins, and Web3 Innovation

The crypto casino landscape in 2025 has evolved into a seamless fusion of decentralized technology and high-stakes entertainment. Leading platforms like Dexsport now offer 10,000+ slot games and multiple roulette variants—all powered by smart contracts across 20 blockchains. Transactions are settled in BTC, ETH, USDT, LTC, and 34 other cryptocurrencies, eliminating traditional banking friction.

Provably fair mechanics and zero-KYC access via MetaMask or Telegram wallets define this new era. Live streaming of tables and audited smart contracts by CertiK set industry standards. The sector's growth reflects broader adoption of crypto payments, with roulette wheels spinning as fast as blockchain confirmations.

Litecoin Price Eyes Breakout – Will $110 Trigger a Fresh Rally?

Litecoin shows renewed bullish momentum as it begins August with a modest recovery. The LTC price gained 1.79% in the last 24 hours, trading at $107.77, with market capitalization rising to $8.14 billion. A bounce from the $103.75 low and a 16.19% surge in trading volume signal growing buyer confidence.

On-chain data reveals robust fundamentals, with active addresses surpassing 402k—a sign of sustained adoption. Historical trends suggest such spikes often precede durable rallies, reinforcing the current bullish outlook. Network participation remains high, even during recent pullbacks, lending credibility to the recovery.

Litecoin Holds Key Support at $106 Post-Halving as Market Eyes ETF Potential

Litecoin stabilizes at $106.97 after completing its third halving event, marking a 1.79% gain as reduced supply dynamics begin influencing the market. The neutral RSI reading of 53.95 suggests balanced momentum, with neither overbought nor oversold conditions prevailing.

Mining rewards halved on July 31st, curtailing new LTC issuance at a time when regulatory delays on spot ETF decisions create temporary uncertainty. This supply-demand tension mirrors Bitcoin's historical halving patterns, where initial price consolidation often precedes longer-term appreciation.

While the SEC's postponement of ETF approval removes an immediate catalyst, market participants interpret the deliberation as preferable to outright rejection. The combination of structural scarcity and potential institutional access points positions Litecoin favorably for the next market cycle.

Will LTC Price Hit 200?

While Litecoin shows bullish technical signals (MACD crossover, holding key support), reaching $200 would require a ~85% surge from current levels. Analyst John highlights these critical factors:

| Factor | Impact |

|---|---|

| ETF Potential | High (could catalyze institutional demand) |

| Halving Supply Shock | Medium (effects may take months to materialize) |

| BTC Correlation | High (LTC often follows Bitcoin's trend) |

Given current technicals and market conditions, John suggests $150 is a more realistic 2025 target unless macro conditions improve dramatically.